美聯儲議息會議筆記:利率水平不變

發表於 2024-06-13 08:19 作者: 智堡

來源:智堡

摘要

本次會議,美聯儲保持利率水平不變。

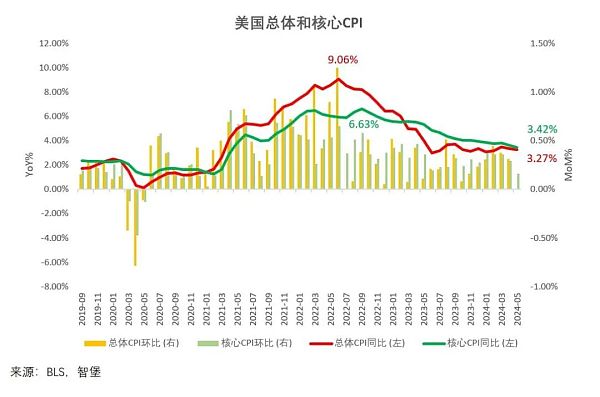

會議聲明中僅有一處重大變化,即從上次會議的通脹下降的過程“缺乏進展”(a lack of further progress)變爲了(modest further progress),以體現昨天剛剛公布的通脹數據(CPI)改善。

QT Taper本月落地。

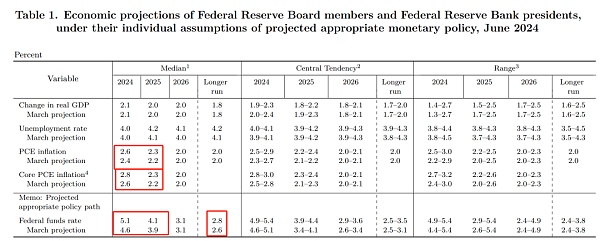

經濟預測的整體變化不顯著,其中值得注意的是通脹預測小幅上調,且由於5月PCE通脹數據已經公布爲2.8%,故此次預測調整給人一種通脹改善已經達標的錯覺。

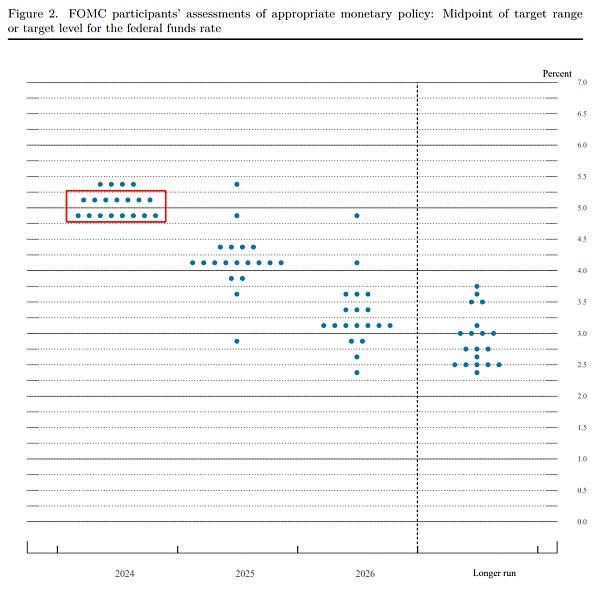

利率點陣圖兌現了此前3月點陣圖中的“上行風險”,有15位委員認爲年內該降息,對降息一次還是兩次存分歧。

長期利率預測連續兩次季末會議上調,體現聯儲官員對長期利率中樞水平預期的微妙變化,但鮑威爾在發布會問答中淡化了這一變化的重要性。

發布會中的鴿派偏見感(Dovish Bias)明顯弱化,主因依然是此前公布的CPI數據改變了發布會的觀感和基調,通脹數據的改善讓鮑威爾顯得更加遊刃有余。

美股市場保持了通脹數據公布後的漲勢但隨後小幅跳水,美債收益率及美元指數則在大跌後回升。

筆者認爲,聯儲或許會在今年8月的傑克遜霍爾會議上明確下半年降息的條件,屆時鮑威爾也將獲得更多充分的通脹數據支持。

圖:鮑威爾的紫色領帶花紋變了,以體現modest further progress,從左至右爲今年上半年的四次會議。

圖:通脹數據的改善讓鮑威爾松了一口氣,也改變了整個發布會的基調與氛圍。

聲明原文(粗體爲關鍵變化)

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. In recent months, there has been modest further progress toward the Committee's 2 percent inflation objective.

最近的指標表明,經濟活動繼續以穩健的步伐擴張。就業增長依然強勁,失業率保持低位。通貨膨脹在過去一年中有所緩解,但仍處於高位。近幾個月來,在實現委員會2%的通脹目標方面取得了適度的進一步進展。

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals have moved toward better balance over the past year. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

委員會力求在長時期內實現充分就業和2%的通脹目標。委員會判斷,在過去一年中,實現就業目標和通脹目標的風險已趨於更好的平衡。經濟前景不明朗,委員會仍高度關注通脹風險。

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to returning inflation to its 2 percent objective.

爲支持其目標,委員會決定將聯邦基金利率目標區間維持在5.25%-5.5%的區間不變。在考慮對聯邦基金利率目標區間進行任何調整時,委員會將仔細評估收到的數據、不斷變化的前景以及風險平衡。委員會預計,在對通脹率持續向2%邁進有更強的信心之前,不宜降息。此外,委員會將繼續減持國債、機構債務和機構抵押貸款支持證券。委員會堅定地致力於將通脹率恢復到2%的目標。

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

在評估貨幣政策的適當立場時,委員會將繼續監測所收到的信息對經濟前景的影響。如果出現可能阻礙實現委員會目標的風險,委員會將准備酌情調整貨幣政策的立場。委員會的評估將考慮廣泛的信息,包括對勞動力市場狀況、通脹壓力和通脹預期以及金融和國際發展的解讀。

點陣圖與經濟預測

伴隨通脹預測的小幅上調,利率預測同樣上調。

長期利率預測繼3月上調後,本次會議繼續上調0.2%的水平。

年內降息1次(7位) vs 降息2次(8位)

一些有趣的發布會細節

再次重復風險平衡的管理姿態

We know that reducing policy restraint too soon or too much could result in a reversal of the progress we've seen on inflation. At the same time, reducing policy restraint too late or too little could unduly weaken economic activity and employment.

我們知道,過早或過度減少政策緊縮可能會導致通脹方面的進展出現逆轉;與此同時,過晚或過少地減少政策緊縮可能會過度削弱經濟活動和就業。

聯儲的利率預測體現了剛剛更新的經濟數據嗎?

Data came out, I think it happened a couple meetings ago, a few meetings ago. So when that happens, when there's an important data print during the meeting, first day or second day, what we do is we make sure people remember that they have the ability to update, we tell them how to do that, and some people do, some people don't. Most people don't. And I'm not going to get into the specifics. But you have the ability to do that, so that what's in the SEP actually does reflect the data that we got today, to the extent you can reflect it in one day.

聯儲官員會在數據實時更新後調整自己當天的SEP預測!只是大多數人(most)不會這么做。

回答記者有關長期利率預測被連續調高的問題

But I want to remember to point out that long run neutral rate of interest is a long run concept. It really is a theoretical concept, it can't be directly observed, and what it is is the interest rate that would hold the economy at equilibrium, maximum employment and price stability, for potentially years in the future where there are no shocks, so it's a little bit -- it's not something we observe today.

But back to your original question, people have been gradually writing it up because I just think people are coming it the view that rates aren't going to -- are less likely to go down to their prepandemic levels, which were very low by recent history measures.

強調長期均衡利率水平不可觀測,但也直言很多官員確實認爲利率回不到疫情前的歷史性低位水平了。

回答有關25bp降息管什么用的問題

I think if you know, if you look back in five or ten years, and try to pull out the significance to the US Economy of one twenty five basis point rate cut, you'd have quite a job on your hands. So that's not how we look at it. You know, really the whole rate path matters, and I do continue to think that when you know, when we do start to loosen policy, that will show up in a significant loosening in financial market conditions, and the market will price in what it prices in, I don't I have no way of saying we're not at that stage, so I don't know.

回看過去的歷史你如果想分解出25bp降息的作用恐怕很難,但我認爲啓動寬松會體現在金融市場環境(泛寬松)上,市場會定價。

(此處筆者打個問號,事實上金融環境的放松和相關定價需要的是持續的前瞻指引和寬松承諾,如果降息周期未來也變得顛簸——比如降息的同時沒能帶來進一步降息的信號,那么市場在當時當刻如何定價更多的寬松?)

回答有關通脹壓力到底在哪兒的問題

You know, in some parts of non housing services, you see elevated inflation still, and that's probably to do with it could be to do with wages, goods, prices have kind of fluctuated. There's been a surprising increase in import prices on goods, which is kind of hard to understand and, you know, may we've taken some signal from that, but you know, and of course, housing services, you're seeing, you're continuing to see high readings there.

鮑威爾認爲服務業(包括住房與非住房)值得警惕,工資也偏高。

標題:美聯儲議息會議筆記:利率水平不變

地址:https://www.coinsdeep.com/article/133651.html

鄭重聲明:本文版權歸原作者所有,轉載文章僅為傳播信息之目的,不構成任何投資建議,如有侵權行為,請第一時間聯絡我們修改或刪除,多謝。

上一篇